Leverage Analysis–Leverage in real estate refers to getting a loan (using debt) to purchase property. When you have money to invest, utilizing leverage can make your money grow exponentially faster.

Let’s go through a hypothetical scenario to see how this works.

Here’s the question…

Given $100,000, what is better to do with the money? Would you buy one $100,000 house cash, or put five 20% down payments (assuming 30 year mortgage at a 5% interest rate) on $100,000 houses?

We will be analyzing the differences between these decisions after one year, 5 years, and 10 years. In both situations we will assume 7% equity growth on our properties.

We will have some constants in both scenarios

All of these imaginary houses are in the exact same neighborhood. Each home in our example is therefore able to bring in the exactly equal Monthly Rental amount of $1200

Taxes and Insurance are also identical in all of our sample houses, but we will not ignore them. We will give them a cost of $200 per month on each house. .

No HOA fees, and no theoretical repairs or vacancies to calculate. This exercise is to see what the same amount of money can do with and without leverage. Any real estate investment can have vacancies, collections, or repairs, but we will assume the risk of these is the same in all of our hypothetical houses.

Now that we’ve got that straight, here we go to the analysis:

Purchase one house outright for $100,000 (no debt).

After one year, there will be a cash flow of $14,400 ($1,200 per month x 12 months). Our one house also pays $200 per month in taxes and insurance, which reduces our cash flow to $12,000 per year

There would be an equity growth of 7%, bringing the value of our investment at the end of year one to $107,000 value.

After 5 years, there will be a cash flow of $60,000 ($12,000 per year x 5 years)

The value of our home will be $140,255. How did we get that?

Remember that we are assuming property value goes up by 7% each year. So, at the end of year 1, the house is worth $107,000

at the end of Year 2 = $107,000 x 1.07 = $114,490 value

at the end of Year 3 = $114,490 x 1.07 = $122,504.30 value

at the end of Year 4 = $122,504.30 x 1.07 = $131,079.60 value

at the end of Year 5 = $131,079.60 x 1.07 = $140,255.17 value

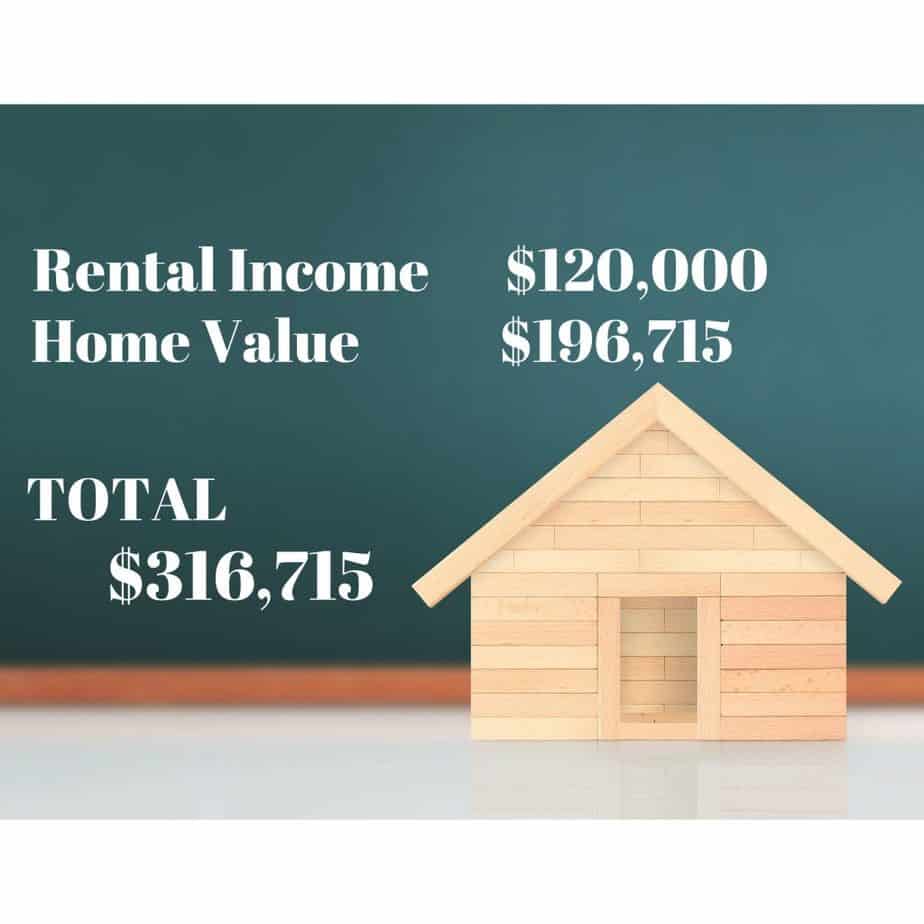

After 10 years, there will be a cash flow of $120,000 ($12,000 per year x 10 years)

The value of the home will be $196,715 (continuing to calculate 7% per year growth).

So at the end of 10 years, we have a total potential profit of $316,715

Next up, the five properties with mortgages

In this scenario, rather than purchasing one home with our $100,000, we’ve decided to purchase 5 homes. In order to do this, we’ve had to get loans on the properties. We’ve put $20,000 down payment on 5 different homes. And we’ve gotten a loan for the balance. Essentially it looks like this:

Now we own 5 homes worth $100,000. Each home has a loan on it that we have to repay. As we mentioned before, we are going to assume we obtain a 30 year loan at 5% (this would be reasonable in today’s lending market).

Utilizing a mortgage calculator, we find that the monthly loan payment to the bank for each house will be $429/mo

Our taxes and insurance payment is $200 on each house. Therefore, each home has a monthly expense of $629.

The Monthly Rental Income is $1200 on each house, minus the monthly expense of $629.

That means that each home has a monthly income of $571. That’s much less than our one home example, but remember, we own FIVE of these homes now. So we need to take our $571 monthly income per house and multiply it by 5. Our monthly income is therefore $2,855

After one year, there will be a cash flow of $34,260 ($2855 per month x 12 months)

Now let’s calculate our value of one property. Each home was worth $100,000 and went up in value by 7%, making it now worth $107,000 at the end of year 1. The five homes are worth $535,000 in value ($107,000 x 5 homes). (Although remember that if you sold these right now, you’d need to pay back the loan on each one so all of that money isn’t yours right now).

After five years, there will be a cash flow of $171,300 ($34,260 per year x 5 years).

What about the home values?

Just like with our single house, the home value went up to $140,255 at the end of 5 years. But this time we have 5 houses, so our total home values are $701,275 ($140,255 x 5). But remember, we do still have outstanding loans on these properties.

After ten years, there will be a cash flow of $342,600, and now let’s delve deeper into our home values and what this would really be worth if we were to sell at this point.

Just as our one home in the first scenario went up to a value of $196,715, so did each of our homes in this example. We have 5 homes, so we multiply $196,715 x 5 and get a value for our properties of $983,575. Now, let’s assume we are really going to cash out at this point. We’d have to pay off those loans and see what we’re really left with. One of the beautiful things about the loans is that we’ve been making payments every month from the tenant’s rent, (remember the $629 we were sending to the bank every month?). Our loan amount has therefore been getting paid down little by little and now we don’t owe $80,000 on each home any more. We now owe $64,915 per house on each loan. All together, that’s a loan debt of $324,575.

So now, our 5 homes are worth $983,575 but we need to pay off the total loan amount of $324,575. So what we would actually keep of the home’s values is a total of $659,000.

Combine this with our rental income of $342,600, and, using leverage, our profit has been a whopping $1,001,600. Congratulations you are now a millionaire in real estate!

Amazing isn’t it?

The same amount of money invested in Scenario 1 yielded you a total of $316,715, but over $1 Million in Scenario 2 where you utilized the power of leverage.

Thanks for delving into this topic and I look forward to your thoughts!

Ready to buy properties? When you do, I hope you’ll purchase my real estate log book. After investing for 20 years, I found that this is the best way for me to keep property info, repair logs, and rental income/expense analysis at hand quickly and easily.

Also consider these other great books on investing that I really like:

As an Amazon Affiliate I earn from qualifying purchases.

If you enjoyed this analysis, here’s another one I think you’ll enjoy:

Analyzing Real Estate Investments… Which Property Would You Buy?

Marcia Castro Socas has been a long time real estate investor and is a Real Estate Broker with Castro Realty Group in Orlando, Florida.